Michelin leads the smart mobility revolution with data and AI

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

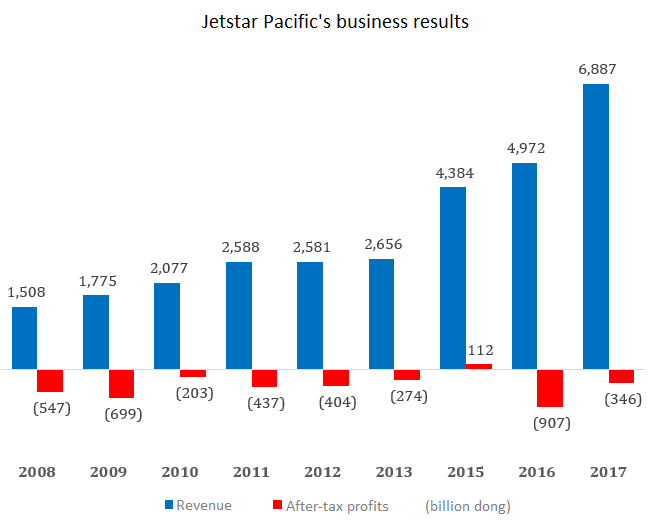

Within five years after being operated by Vietnam Airlines, Jetstar Pacific has never competed with VietJet Air and it also broke loss records even though its revenue has grown in line with the overall trend of the market.

In the first half of 2018, the local aviation industry received positive signals. Despite the high increase in fuel prices since late 2017, airlines have enjoyed benefits from the growing demand for air travel.

Vietnam Airlines, the largest airline in the country, reported steep profits thanks to the increase in the number of passengers. The airlines recorded consolidated revenue of VND47.5 trillion ($2.04 billion), up 18 per cent year on year and profit of over VND1.5 trillion (roughly $64 million), doubling that of the same period last year.

However, on the stock market, Vietnam Airlines’ share price is just around VND37,000 ($1.59) each. On the contrary, its rival VietJet Air has enjoyed the consecutive increase in share price at over VND150,000 ($6.45) each since last month.

In spite of being incomparable with Vietnam Airlines in terms of scale and coverage in the aviation market, the stock market statistics show that VietJet Air’s shares are much more profitable. The difference in share price also helped VietJet Air achieve VND83 trillion ($3.56 billion) in capitalization, one-and-a-half times higher than that ($2.23 billion) of Vietnam Airlines.

Vietnam Airlines’ huge cost and unprofitable subsidiaries, especially Jetstar Pacific (JPA), make its shares less attractive to investors.

JPA is a joint venture between Vietnam Airlines and Qantas Airways, of which Vietnam Airlines holds nearly 70 per cent of charter capital.

Having been put into operation since 2008, JPA is the first low-cost carrier (LCC) in Vietnam. However, unlike VietJet Air, JPA cannot expand its scale and has never escaped losses within the past 10 years.

In the period from 2008 to 2009, JPA reported a loss of nearly VND700 billion ($30 million) on a revenue of only VND1.7 trillion ($73 million). JPA explained that the loss resulted from fuel hedging and a fine caused by the cancellation of the aircraft lease contract signed in 2008.

The thing that an airline suffered a huge loss from fuel hedging often results from its failure to accurately forecast demand for fuel during the year. However, if looking at JPA’s revenue and the number of passengers that have remained stable over the years, the loss up to hundreds of billion dong raises a question about JPA’s ability to speculate on fuel prices.

In the period 2010-2011, JPA still suffered losses in which the loss in 2011 doubled that of 2010, to over VND430 billion ($18.5 million). According to JPA, these losses were due to the impact of the global economic crisis, the increasing cost of jet fuel, etc.

Consequently, on January 16, 2012, the Government requested to transfer State's capital at JPA from SCIC to Vietnam Airlines. Vietnam's national airline has to take care of a “burden” with a trillion-dong loss and set a plan to restructure JPA.

The fact that a full-service carrier (FSC) like Vietnam Airlines owns an LCC like JPA is common sense. Similarly, Singapore Airlines owns Scooter (merged with Tiger Airways).

Within five years after being operated by Vietnam Airlines, JPA broke loss records even though its revenue has grown in line with the overall trend of the market.

Specifically, the low-cost carrier reported a net loss of nearly VND900 billion ($38.6 million) in 2016 and an operating loss of VND1 trillion ($43 million) in 2017. Thanks to another profit of over VND700 billion ($30 million), JPA's loss last year dropped to VND346 billion ($14.8 million).

To maintain operations and expand its fleet to 30 Airbus A320s aircraft by 2020, JPA has to use a large financial leverage. The carrier’s short-term debt reached VND2,475 billion ($106 million) in 2016 and dropped to VND345 billion ($14.8 million) last year.

At the end of 2017, JPA’s accumulated loss reached nearly VND4.3 trillion ($184 million), exceeding its charter capital. In the annual reports, Vietnam Airlines still assessed JPA as an indispensable business sector.

However, experts said that for either short-term investors on the stock market or long-term strategic investors, it is not a good option to partner with a firm owning a member which suffers a trillion-dong loss, especially when the aviation industry is offering a better choice.

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.

Taseco Land has shifted its listing to HOSE and introduced a new upward-pointing arrow logo - a visual statement of its strategy to raise capital, expand its land bank, and strengthen its standing in Vietnam’s real estate sector

Located in the heart of Ho Chi Minh City, SAP Labs Vietnam is the second SAP Labs Network hub in Southeast Asia, following Singapore and is one of 20 countries that have SAP Labs globally.

Solar & Storage Live Vietnam event has been running since 2017 and the 2025 edition will be the biggest yet.