Michelin leads the smart mobility revolution with data and AI

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

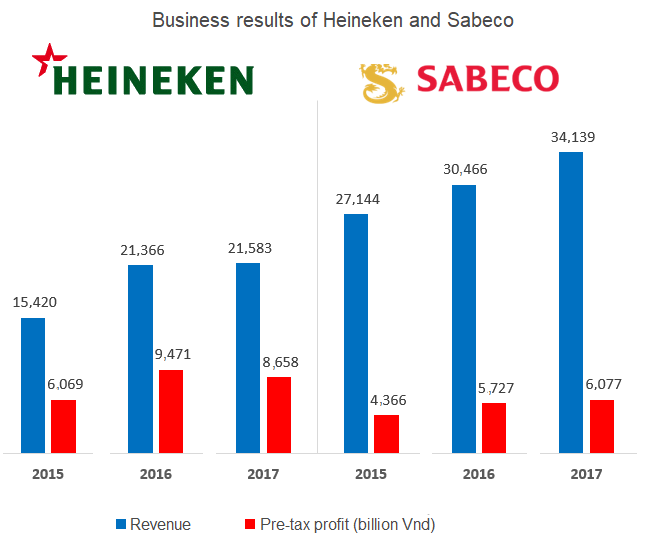

Heineken Vietnam Brewery recorded a profit margin of 40 per cent, much higher than Sabeco's 17.6 per cent but its market share still lagged behind its rival which is dominating the beer industry.

In 2017, beer output in Vietnam reached over 4 billion litters, up 6 per cent compared to 2016. Saigon Beer - Alcohol - Beverage Corporation (Sabeco) alone sold nearly 1.8 billion litres of beer, equivalent to 40 per cent of total beer consumption nationwide.

Despite leading the market in terms of scale, Sabeco is not the most profitable brewing company in Vietnam in case of business efficiency. Heineken Vietnam has a lower market share, but its profits have been many times higher than those of Sabeco over the years.

Having been present in Vietnam since the 90s of last century, it can be said that Heineken is one of the successful foreign beer brands in Vietnam. Heineken has two brewers, Heineken Vietnam Brewery Co., Ltd (Heineken Vietnam Brewery) and Heineken Hanoi Brewery Co., Ltd (Heineken Hanoi Brewery).

In particular, Heineken Vietnam Brewery is a joint venture between Heineken Group and Saigon Trading Group (Satra). The company has a main factory located in Ho Chi Minh City and four factories located in Da Nang city, Quang Nam, Tien Giang and Ba Ria Vung Tau provinces. Besides, Heineken Vietnam is also building a new brewery in Nghe An province.

Heineken Hanoi Brewery, previously known as Asia Pacific Brewery (Hanoi) Limited, aims to serve the northern market and is 100 per cent owned by Heineken.

Focusing on the premium beer segment with prices far higher than those of Sabeco or Habeco, Heineken does not need to sell too much beer to achieve the same amount of revenue. In 2016, Heineken Trading, which is in charge of distributing beer for the Heineken system in Vietnam, reported revenue of VND33.9 trillion ($1.45 billion), slightly higher than Sabeco's consolidated revenue of VND30.6 trillion ($1.31 billion).

While there was hardly a difference in revenues between Heineken and Sabeco, there existed a very large gap in profits between two companies. Sabeco's consolidated pre-tax profit in 2016 was only VND5.7 trillion ($250 million), equal to 60 per cent of the pre-tax profit of Heineken Vietnam Brewery.

Similarly, in 2017, Heineken Vietnam Brewery had a pre-tax profit of VND8,658 billion (nearly $372 million), much higher than that of VND5,077 billion ($218 million) of Sabeco’s whole system.

Regarding profitability in 2017, Heineken Vietnam Brewery achieved revenue of VND21.5 trillion ($923 million) and equivalent to 40 per cent of pre-tax profit, much higher than Sabeco's similar profit margin of only 17.6 per cent.

Despite doing a 'super profitable' business, Heineken Vietnam Brewery did not obtain steep profit as expected last year. Its revenue grew by only one per cent while cost price and selling cost all rose. As a result, the company's profit dropped by more than VND800 billion ($34.3 million) compared to the previous year.

Heineken’s good business performance also brings the great benefits to its Vietnamese partner Satra. Currently, Satra holds a 40 per cent stake in both Heineken Vietnam Brewery and Heineken Trading.

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.

Taseco Land has shifted its listing to HOSE and introduced a new upward-pointing arrow logo - a visual statement of its strategy to raise capital, expand its land bank, and strengthen its standing in Vietnam’s real estate sector

Located in the heart of Ho Chi Minh City, SAP Labs Vietnam is the second SAP Labs Network hub in Southeast Asia, following Singapore and is one of 20 countries that have SAP Labs globally.

Solar & Storage Live Vietnam event has been running since 2017 and the 2025 edition will be the biggest yet.