Business

Great opportunities for foreign investors in Vietnam's education

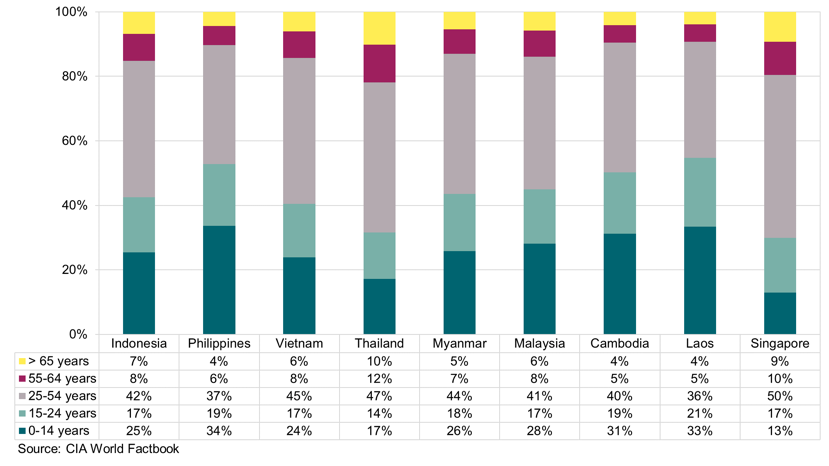

With 41 per cent of the population aged within the golden demographic and the rapid increase in high net worth individuals’ and middle-class families, Vietnam is becoming a fertile land for foreign investors to jump in education projects as regulations are stimulating.

Evolving toward a more modern structure, approximately one million Vietnamese moved annually between 2014 - 2017, from agriculture to service and industrial sectors. Rapid urbanization will continue, thus national education development is a priority to improve the skills of the labor force and increase productivity.

According to Deputy Managing Director Savills Vietnam Troy Griffiths, with a large population of over 94 million and a young age structure, Vietnam is well placed for expansion of the education sector, however, needs to emphasise advancing the quality.

As domestic education often fails to meet international standards, many wealthy households elect to educate their children abroad. According to UNESCO Institute for Statistics, Vietnam outbound students increased by an average of 12 per cent per year from 50,000 in 2012 to approximately 80,000 in 2016. These numbers suggest alternate choices in local education are needed and highlights the potential for investment in this sector.

Great opportunities

Due to heavy workloads, lofty expectations and chequered delivery at public schools, it is common for students to participate in private classes and training courses, in addition to their everyday schooling. The ambition of Vietnamese students desiring higher education often exceeds global levels.

Ho Chi Minh City is one of only 27 cities worldwide with over 50 international schools. These foreign schools not only provide education for expatriate children but also local families wishing to enroll their children in an institution providing international qualifications. The majority of foreign schools in Ho Chi Minh City have many Vietnamese children awaiting admission, however, are prevented due to government regulations limiting domestic students in international schools.

Taking effect on August 1, 2018, Decree 86 raised the limit of local enrolments in foreign-invested schools. This Decree now accepts half of Vietnamese students in international schools. The ratio was previously capped at 10 per cent for the primary/elementary level and 20 per cent for the secondary/high school level.

Troy Griffiths stated that the decree update represents a great opportunity for investors wishing to develop international schools in Vietnam. The limit on local students was previously a major barrier for foreign investment within the education sector, particularly in provinces outside Hanoi and Ho Chi Minh City, which attract fewer expatriates, yet are home to wealthy Vietnamese willing to invest in their children’s education.

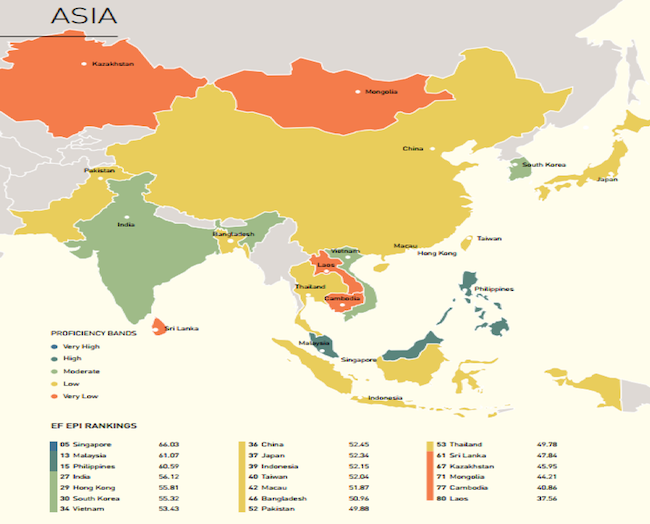

English training center developments have grown significantly in the last few years. Ho Chi Minh City and Hanoi have approximately 450 English language centers; in which, ILA is the market leader, whilst the emerging APAX is rapidly increasing market share. In the Education First English Proficiency Index (EFEPI) 2017, Vietnam ranks 7th in English Proficiency, indicating the ambitious nature of the country.

According to Savills, many M&A’s have recently closed within the education industry. Cognita, an education fund, purchased International School of Ho Chi Minh City and Saigon Pearl Primary School. The North Anglia fund bought British International School, whilst TPG, a US investment fund, acquired the Vietnam-Australia School.

EQT invested in ILA, a popular chain of English centers. IFC poured money into the Vietnam - US Society English Centers; Mekong Capital in the YOLA English Center; and IAE in Western University. This high level of investment in foreign schools shows the potential for international education development.

State-owned universities and colleges in Vietnam only have the capacity for 600,000 of the 1.8 million candidates who undertake the national university entrance examination, showing the vast demand for domestic higher education.

Local graduates have struggled to find jobs in their respective fields, as they are not well equipped with the necessary practical skills. Although the government prioritises collaboration with international universities and attempts to provide a wide range of options for local students, the number of Vietnamese seeking education overseas has steadily increased, with students choosing to complete university in USA, Australia, Japan, and France. Thus, proper tertiary options with internationally recognized degrees as well as relatively competitive tuition fees is a promising investment.

Still a number of challenges

The leader of Savills Vietnam expresses that there are several challenges to overcome when investing in education in Vietnam. Education is still recognised as one of the most poorly governed industries within Vietnam, with bribes for school entrances, examinations and good grades appearing across all school levels.

Plagiarism in higher education, cheating in tests and examinations, counterfeit academic degrees and falsifying educational budgets for personal interest are frequently reported cases, but not the entire picture. There has been significant recent media attention focusing on these transgressions. Urgent involvement, transparent investigations, and harsh punishments are required to alleviate this entrenched, ongoing issue.

Strict regulations from local governments may be a challenge for foreign investors. High taxation; the minimum capital foreign investment required for each type of institution and partnership; staffing requirements and lengthy and complicated approval procedures are entry barriers for any investor.

The newly implemented Decree 86 allows for five types of foreign-invested institutions: short-term training institutions; pre-school education establishments; high-school institutions (elementary, middle, high and mixed-levels); higher education institutions and branches of international higher education institutions.

According to Savills, with 41 per cent of the population aged within the "golden demographic" (<24 years old) and the rapid increase in high net worth individuals and middle-class families, Vietnamese will soon be able to pay more to provide their children with higher education standards.

"Strong demand for high-quality education is anticipated; however, what scale and form the new supply will take is still the question need to be answered," said Troy Griffiths.

Can foreign universities improve the standard of higher education in Vietnam?

Maersk rolls out electric trucks for inland transport in Vietnam

A.P. Moller–Maersk will deploy a fleet of heavy-duty electric trucks for inland container transport in Vietnam starting in the first quarter of 2026.

Grab and Charge+ partner to develop electric vehicle charging network in Vietnam

The partnership aims to expand the system of charging and battery swapping stations, providing Grab driver-partners and other EV users with easy access to flexible and reliable charging solutions.

Samsung Vietnam appoints its first Vietnamese senior executive

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

Michelin leads the smart mobility revolution with data and AI

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek secures $200 million IFC loan following revenue drop

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

Leading with empathy in Vietnam’s billion-dollar investment flows

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.