Samsung Vietnam appoints its first Vietnamese senior executive

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

After changing ownership, the operation of Big C in Vietnam is not very optimistic, especially with the decline in business result of Big C Thang Long, one of the largest Big C in Vietnam.

Appearing in Vietnam since 1998, Big C is one of the very first models operating under the structure of supermarket chain.

With more than 30 shopping centers, this supermarket is one of the largest retailers in Vietnam, which have total sales of over $432 million and a steady growth over the years.

In early 2016, Groupe Casino, a French mass retailer agreed to sell Big C Vietnam to the Central Group, a family-owned conglomerate holding company in Thailand that is involved in merchandising, real estate, retailing, hospitality and restaurants, with the amount of over $1.17 billion.

Big C Vietnam was quickly restructured after its ownership transfer. The new owner has put Big C into its Central Group system in Vietnam, along with Nguyen Kim shopping center and Zalora, an e-retailer.

The Gioi Di Dong, the top mobile retailer in Vietnam was also suffered significantly from this restructure since 22 selling locations of The Gioi Di Dong in Big C were quickly liquidated to make room for Nguyen Kim.

Nevertheless, two years after the change of ownership, the operation of Big C in Vietnam is not very optimistic, especially with the decrease in business result of Big C Thang Long, one of the largest Big C in Vietnam.

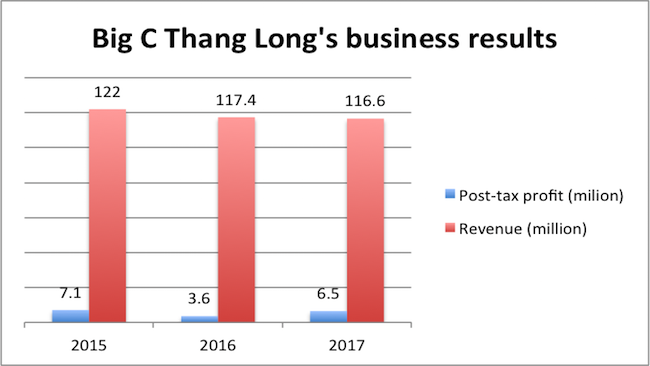

In 2015, before being sold to the Central Group, Big C Thang Long recorded a revenue of roundly $122 million. Since then the supermarket's revenue continued to fall with the revenue in 2016 reaching $117.4 million in 2016 and $116.6 million in 2017 respectively.

The profit of Big C Thang Long also decreased sharply from $7.1 million in 2015 to $3.6 million in 2016. In 2017, the profit growth showed sign of recovery at $6.5 million.

The weak operation of Big C Thang Long in such strong economy recovery and in a market with increasing demand for shopping through modern retail channels of consumers partly reflects the fierce competition of the retail industry.

According to AT Kearney, an American global management consulting firm, Vietnam is among the 30 most attractive retail markets in foreign investors' viewpoint. It is forecasted that between 2016-2020, the market will have an average growth of 11.9 per cent.

A dense appearance of convenience stores such as Circle K, Vinmart +, 7Eleven in the heart of residential areas has made the shopping activities of people become more convenient, hence supermarket like Big C becomes less favourable.

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.

Taseco Land has shifted its listing to HOSE and introduced a new upward-pointing arrow logo - a visual statement of its strategy to raise capital, expand its land bank, and strengthen its standing in Vietnam’s real estate sector

Located in the heart of Ho Chi Minh City, SAP Labs Vietnam is the second SAP Labs Network hub in Southeast Asia, following Singapore and is one of 20 countries that have SAP Labs globally.