Samsung Vietnam appoints its first Vietnamese senior executive

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

Faster growth in both the government and corporate bond segments pushed Vietnam’s local currency bond market to reach $91.5 billion in the end of last year, up by 9.8 per cent from the third quarter of 2021.

Annual growth also quickened, to 25.5 per cent, according to Asian Development Bank’s (ADB) lastest data.

In details, in the last three months of 2021, government bonds increased 5.3 per cent from the previous quarter to $65.3 billion.

A jump in issuance drove a 22.7 per cent expansion in the corporate bond segment. Corporate bonds outstanding totaled $26.3 billion.

Corporate bond issuance in Vietnam jumped 30.8 per cent quarter on quarter in the fourth quarter of 2021 to VND123.4 trillion as more firms turned to the bond market to raise funds.

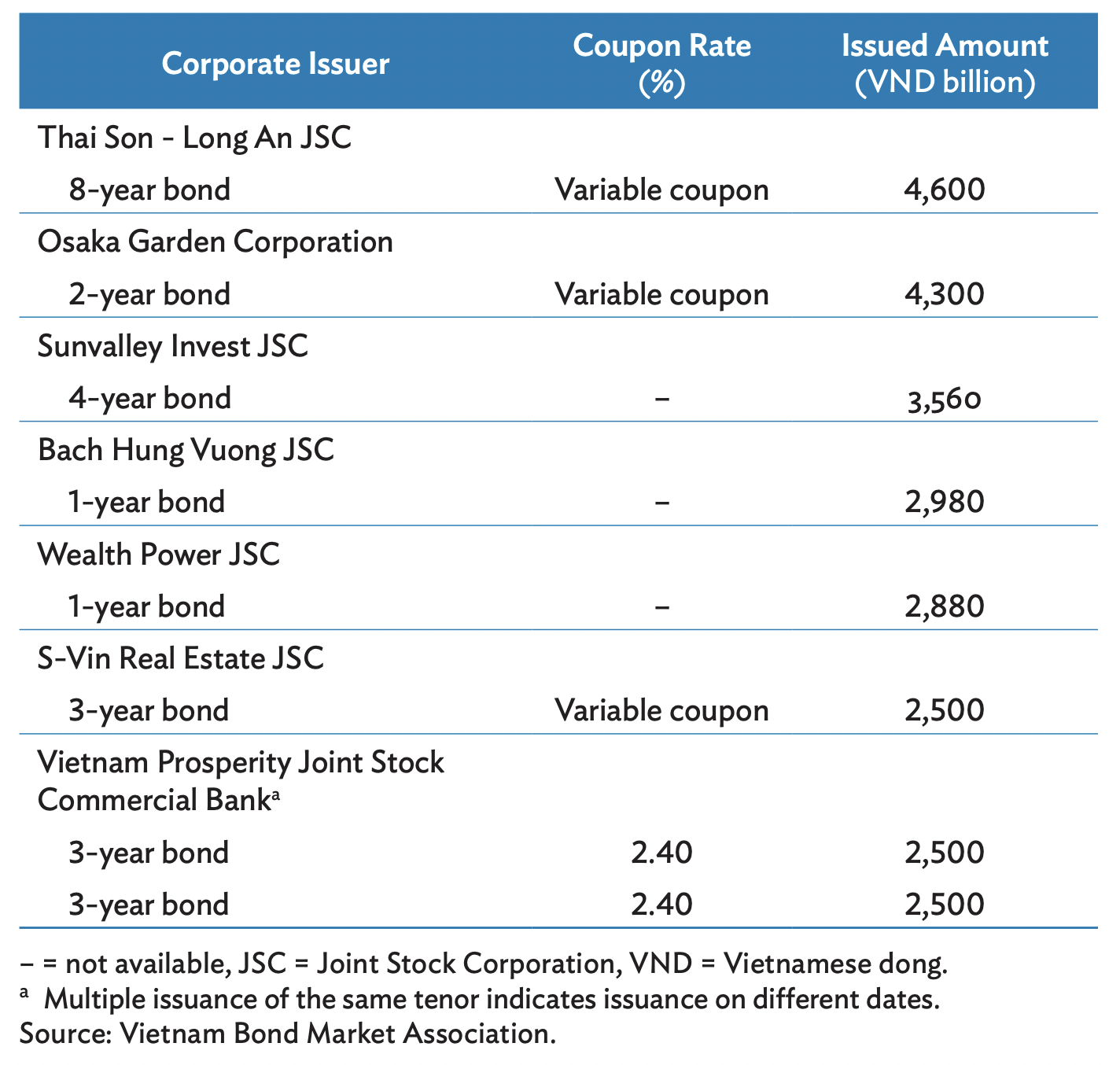

One of notable bond sales during the time was Thai Son – Long An JSC – a member of T&T Group with a single VND4.6 trillion issuance, followed by Osaka Garden Corporation with VND4.3 trillion one.

The largest debt issuers in last quarter of 2021 were mainly from the property sector.

In Emerging East Asia, the total local currency bond issuance rose over 7 per cent to an all-time high of $9 trillion in 2021. Bond yields in the region rose between 30 November and 9 March, amid global inflationary pressure and rising yields in advanced markets.

Risk premiums have edged up amid dampened investor sentiment due to expected monetary tightening by the US Federal Reserve and the Russia – Ukraine tension.

The Federal Reserve hiked interest rates on 16 March for the first time since 2018 and signaled additional increases on the horizon as inflation picks up, partly due to war-related increases in oil and food prices.

Global supply chain disruptions and the uncertain trajectory of the coronavirus disease pandemic are also threatening the global economic outlook.

“Financial conditions in emerging East Asia remain robust, backed by ample liquidity,” said ADB Chief Economist Albert Park. “Most central banks in the region have maintained accommodative monetary stances, even as advanced economies tightened policies. However, continued inflationary pressure may cause more central banks around the world to tighten, which could reduce liquidity and weaken financial conditions.”

Sustainable bond stock in the ASEAN region plus China, Hong Kong, Japan and South Korea rose to $430.7 billion at the end of 2021 from $274.1 billion a year earlier.

Green bonds continue to dominate the region’s sustainable bond market, accounting for 68.2 per cent of the total, while interest in social and sustainability bonds is also growing.

Samsung Vietnam appoints Nguyen Hoang Giang to SEVT senior leadership, the first Vietnamese executive in the company’s local manufacturing units.

Michelin is undergoing a strong transformation by applying AI and smart analytic, helping lead the smart, safe, and sustainable mobility revolution in the Industry 4.0 era.

LG Innotek Vietnam Hai Phong secured a $200 million IFC loan as revenue slows, aiming to expand camera module production while meeting sustainability targets.

For Koen Soenens, Sales and Marketing Director at DEEP C, empathy is a compass that guides major deals, the way a leader builds a team, and the ambition to create a sustainable industrial zone that carries a Vietnamese identity.

Taseco Land has shifted its listing to HOSE and introduced a new upward-pointing arrow logo - a visual statement of its strategy to raise capital, expand its land bank, and strengthen its standing in Vietnam’s real estate sector

Located in the heart of Ho Chi Minh City, SAP Labs Vietnam is the second SAP Labs Network hub in Southeast Asia, following Singapore and is one of 20 countries that have SAP Labs globally.